Note: this is part 2 of blog post on VC investments into “Online games and Related Entertainment” segment. See also part 1.

The $1,7 billion top-line figure for “online game-like entertainment” VC investments in years 2007-2008 is a stupendous figure, and more analysis is needed to make sense of it and to see trends within the huge aggregate sum. The analysis on this post focuses almost solely on the Virtual worlds, Casual MMO, social games and casual games sector, as this is the sector in which my company Everyplay operates. My earlier post on this sector was titled “$350 million invested this year“, and with latest data that figure needs to be upped to $481 million.

The doom & gloom of the past month sure to get to any entrepreneur. Luckily, there is one sector that at least can claim to be counter-cyclical (see e.g. Lazard Capital’s and John Doerr’s comments, and NPD reporting 17% year-on-year increase in video game sales in October). There is further proof as this sector attracted ten VC investments in October to the tune of $53 million. Naturally these deals have been set in motion already before the financial crisis, but it’s very encouraging to see these deals close in the face of “R.I.P Good Times“.

Contents

Key findings

July 2008 was the biggest “organic” month so far for venture capital investments into virtual worlds, casual MMOs and casual & social games to date. Altogether 11 deals were announced in July totaling $71 million. The month’s investments were led by Zynga’s $29 million and Gaia’s $11 million funding rounds. July was the biggest “organic” month in terms of deals concluded as well as the total size of deals so far. There have been months dominated by huge deals (e.g. $100 million into 9You and $83 million into Big Fish Games), but those are one-offs and need to be excluded when looking at the bigger picture.

The investments in this sector have averaged around $20 million per month for 2007-2008. The investments into the sector continued strongly in October, which was led by $20 million funding for Oberon and $17 million funding for Playfish. The big question is what happens now. The first half of November has been very quiet on VC funding deals. It is likely that July 2008 will keep its peak month status for at least next 12-18 months, but we’ll eventually see larger months because the sector is young. New entrants will continue to flow in and the best growth companies will need further funding to reach their goals.

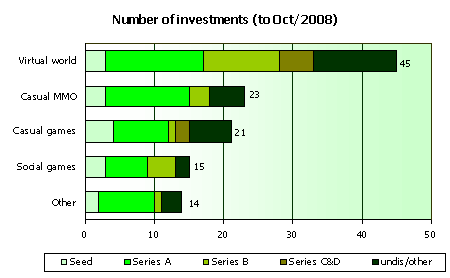

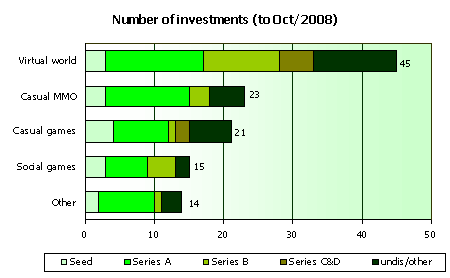

In the years 2007-2008 most of the VC money flowed into Virtual Worlds (39 deals, $171 million), followed quite closely by casual games and social games/apps. The average deal size at Series A is around $3-4 million, which matches the common wisdom for Series A.

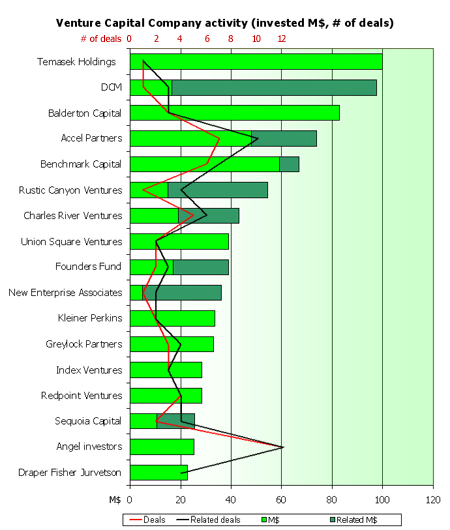

The VCs investing into this sector read like the VC all star list (Benchmark, Accel, Kleiner Perkins, Draper Fisher Jurvetson, Balderton, Sequoia). Accel Partners is the top dog when considering both the number of deals and the size of deals participated in.

Investment rate

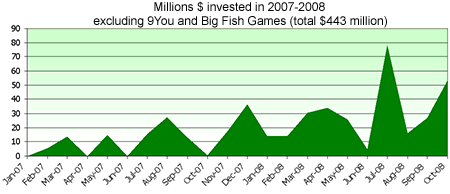

The Virtual worlds, Casual MMO and Casual & Social games sector that I’ve analysed in more detail in this post has been very attractive to VCs. The sector investments total an amazing $625 million in years 2007 and 2008 as shown in the diagram:

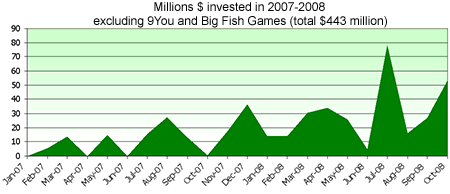

The $100 million 9You and $83 million Big Fish Games funding rounds skew the investment rate diagram a lot. By excluding them we get to a more “organic” investment rate, that has been averaging around $20 million per month in years 2007 and 2008 as shown in the diagram below:

In this “organic investment rate” diagram there are two major peaks:

- July 2008: 11 investments totaling $71 million, led by Zynga’s $29 million and Gaia’s $11 million funding rounds

- October 2008: 10 investments totaling $53 million, led by Oberon’s $20 million and Playfish’ $17 million funding rounds

July 2008 shows the peak of investments with most deals and largest sum of money invested. On the face of the current market turmoil, it is very encouraging to see October 2008 to be a very strong month. One reason for October’s strong performance could be that companies are following the advice to “raise money NOW if you can”. If so, we should see a rapid drop off in investments in the coming months. Given that November 2008 is starting to look like a dry month, this might be more true than us entrepreneurs would like it to be. Given the economic downturn I expect July 2008 to remain the biggest organic month for the next 12 months.

Most active VCs

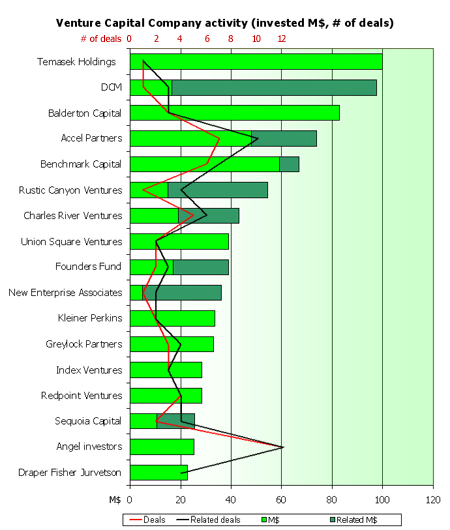

The usual suspects populate the TOP10 lists of the most active VCs and the most heavily investing VCs. When you combine these two TOP10 lists, the most prominent VCs in this space read like the who’s who of venture capital (for comparison, see Fortune’s Midas list and Entrepreneur.com’s TOP100 early stage VC list). The diagram below shows the VC with largest fundings participated in (bars) and largest number of deals (line graph). When reading the table, please bear in mind that the investment bar graph shows the total value of deals the VC company participated in, not the actual amount a particular VC company has invested. So if two VC companies participated in a 5 M$ deal, then both companies are credited in this analysis with 5 M$ as there is no data available on how the investments are split between VC companies.

I’ve shown in the figure above also deals in the related sectors to showcase the VC company’s participation in the total $1,7 billion invested in years 2007-2008. Please note that investments in the related categories (MMORPG and technology etc) are only shown on the table above if the VC company also has made investments in the Virtual Worlds, Casual MMO, Social games and Casual games sector. Thus e.g. Providence Equity Partners that provided $300 million to Zenimax Media (MMORPG) has been omitted.

Accel Partners leads the pack when considering both the number of deals completed and the total value of deals participated in. Accel has been very active investing into developer-operators (e.g. Playfish and GameForge), but has also investments in related sectors (Mochi Media, a game advetising network and Raptr, a social network for gamers). Benchmark Capital is a close second with a large number of deals and almost as high total deal size. Benchmark has also been investing into developer-operators (e.g. Gaia, WeeWorld, Sulake, Grockit).

The figure below shows a selection of the most active VCs and their portfolio companies.

Overall it is clear that the sector has been very attractive to all of the most profilic VC funds in Silicon Valley and London. The companies that are able to attract investment from this all star cast of VCs are definitely on the top of their game.

Note: Balderton Capital is the former European office of Benchmark Capital. Certain deals may be listed under Benchmark, when they might have been done by Balderton (Benchmark Europe).

Distribution of investments by company category

My sector definition encompasses virtual worlds and casual MMOs (persistent, online worlds) as well as social and casual games, which makes the category quite broad. The sub-category that clearly dominates the investments in Virtual Worlds, that has taken the biggest number of deals as well as the largest total sum. Casual games are a close second on deal size thanks to the huge investment (83 M$) into Big Fish Games.

Note: Please see my category definitions to understand how companies have been grouped and important caveats to the methodology.

Social games have been funded very seriously compared to the costs it takes to develop these games. The key reason I can think for the investments of this magnitude that there is a “landgrab” going on. The development costs of social games are neglible compared to the costs of developing a full-blown virtual world or a casual MMO, so the money is going into growing the businesses thru acquisitions and erecting barriers to entry (e.g. by investing into higher game quality). The competition between Zynga and Social Games Network is looking very much like the widget wars between Slide and RockYou. That duel has recently been turned into a three party free-for-all, as PlayFish has in one years time emerged as a very serious contender. With the most recent funding from Accel Playfish has the checkbook to play ball with Zynga and Social Games Network.

Unlike Zynga and SGN, Playfish hasn’t so far purchased any third party games or developers. It’ll be interesting to see who is going to be their first acquisition target, although with several titles in TOP10 on Facebook, they aren’t probably in a huge hurry to go a buying spree.

Average deal size

The average investment size in Series A is around 3-5 M$, which is exactly as you’d expect it to be. The seed rounds are quite large (averages even close to 1 M$ in certain categories), which is probably due to the fact that only high value fundings get the press spotlight, and thus the dataset doesn’t include many of the smaller deals.

Distribution of investments by stage

The Virtual worlds, Casual MMOs and Casual & Social games sector is a young one. The majority of deals (# of deals and value of deals) are made in the Seed and Series A phase.

The list below summaries the deals from years 2007 and 2008 (to October):

- Seed: 13 deals, worth 12 M$

- Series A: 42 deals, worth 249 M$

- Series B: 16 deals, worth 128 M$

- Series C & later: 4 deals, worth 44 M$

- Undisclosed stage: 27 deals, worth 193 M4

Here are timeline breakouts of the investments per funding stage.

Data spreadsheet

The data on VC investments has been collected from publicly available sources including but not limited to

The data was gathered by Jussi Laakkonen and Adam Martin.The data is most accurate for year 2008. Year 2006 and earlier years have been only covered sporadically and typically only for companies that have received follow-up funding in year 2008. The data is provided AS IS and the authors make no warranties about its accuracy.

Download the full spreadsheet with categorizations:

The data is licensed under the Creative Commons Attribution, Non-Commercial license.

The data is licensed under the Creative Commons Attribution, Non-Commercial license.

Summary list of VC investments

A summary list of VC investments in the Virtual worlds, Casual MMO, Social games and Casual games sector is shown below:

| Date |

Company |

Invested |

Category |

| Oct-08 |

Playfish |

$17,0 |

Social games |

| Oct-08 |

Metaplace |

$6,7 |

Casual MMO |

| Oct-08 |

Second Interest |

$0,5 |

Virtual world |

| Oct-08 |

Kirkland North |

$0,2 |

Social games |

| Oct-08 |

Booyah |

$4,5 |

Other |

| Oct-08 |

Ray Flame Entertainment |

$0,8 |

Casual MMO |

| Oct-08 |

Oberon |

$20,0 |

Casual games |

| Oct-08 |

Farbflut Entertainment |

undis |

Casual MMO |

| Oct-08 |

MindFuse |

$1,0 |

Casual MMO |

| Oct-08 |

Taatu |

$2,5 |

Virtual world |

| Sep-08 |

Challenge Games |

$10,0 |

Casual MMO |

| Sep-08 |

Big Fish Games |

$83,0 |

Casual games |

| Sep-08 |

RobotGalaxy |

$5,0 |

Virtual world |

| Sep-08 |

Hollywood Interactive |

$5,0 |

Virtual world |

| Sep-08 |

RobotGalaxy |

$7,0 |

Virtual world |

| Aug-08 |

Nonoba |

$1,7 |

Casual games |

| Aug-08 |

LOLapps |

$4,5 |

Other |

| Aug-08 |

Webcarrz |

$4,0 |

Virtual world |

| Aug-08 |

Knowledge Adventure |

$5,0 |

Virtual world |

| Aug-08 |

Dizzywood |

$1,0 |

Virtual world |

| Jul-08 |

Challenge Games |

$4,5 |

Casual MMO |

| Jul-08 |

Zynga |

$29,0 |

Social games |

| Jul-08 |

Virtual Tweens |

$1,0 |

Virtual world |

| Jul-08 |

Monte Cristo Games |

$7,0 |

Casual MMO |

| Jul-08 |

Playfish |

$1,0 |

Social games |

| Jul-08 |

Gaia Interactive |

$11,0 |

Virtual world |

| Jul-08 |

Six Degrees Games |

$7,0 |

Casual MMO |

| Jul-08 |

Social Gaming Network |

$3,0 |

Social games |

| Jul-08 |

Young Internet |

$4,7 |

Virtual world |

| Jul-08 |

Riot Games |

$7,0 |

Casual MMO |

| Jul-08 |

Atomic Moguls |

$1,0 |

Casual MMO |

| Jul-08 |

8D World |

$1,0 |

Casual MMO |

| Jun-08 |

Erepublik |

$0,7 |

Casual MMO |

| Jun-08 |

I’m in like with you |

$1,5 |

Social games |

|

Jun-08

|

Lumos Labs |

$3,0 |

Other |

| May-08 |

Social Gaming Network |

$15,0 |

Social games |

|

May-08

|

Grockit |

$8,0 |

Other |

|

May-08

|

Caspian Learning |

$2,8 |

Other |

| Apr-08 |

Serious Business Inc |

$4,0 |

Social games |

| Apr-08 |

Kongregate |

$3,0 |

Casual games |

| Apr-08 |

Northworks |

undis |

Casual games |

| Apr-08 |

Club Cooee |

undis |

Virtual world |

| Apr-08 |

Akoha |

$2,0 |

Other |

| Apr-08 |

Metaversum |

several m€ |

Virtual world |

|

Apr-08

|

Nurien Software |

$15,0 |

Virtual world |

|

Apr-08

|

Bunchball |

$4,0 |

Social games |

|

Apr-08

|

Play Hard Sports |

$5,0 |

Casual MMO |

|

Apr-08

|

Numedeon |

$1,0 |

Virtual world |

|

Apr-08

|

Eximion |

Undis |

Casual games |

|

Mar-08

|

Hangout Industries |

$6,0 |

Virtual world |

|

Mar-08

|

Playfish |

$3,0 |

Social games |

|

Mar-08

|

9You |

$100,0 |

Other |

|

Mar-08

|

Simmersion Holdings |

$1,9 |

Virtual world |

|

Mar-08

|

Chapatiz |

$0,5 |

Virtual world |

|

Mar-08

|

EveryScape |

$7,0 |

Virtual world |

|

Mar-08

|

Fluid Entertainment |

$3,2 |

Virtual world |

|

Mar-08

|

Gamook |

$1,5 |

Casual games |

|

Mar-08

|

Handipoints |

$0,8 |

Virtual world |

|

Mar-08

|

Alamofire |

$2,0 |

Social games |

| Mar-08 |

PopJax |

$4,7 |

Casual games |

| Feb-08 |

Dizzywood |

$1,0 |

Virtual world |

| Feb-08 |

Sparkplay Media |

$4,3 |

Casual MMO |

| Feb-08 |

Flowplay |

$3,7 |

Casual MMO |

| Feb-08 |

Atomic Moguls |

$1,0 |

Casual MMO |

| Feb-08 |

RocketOn |

$5,0 |

Other |

| Jan-08 |

C3L3B Digital |

$3,0 |

Virtual world |

| Jan-08 |

Zynga |

$10,0 |

Social games |

| Jan-08 |

Rebel Monkey |

$1,0 |

Casual MMO |

| Dec-07 |

Playfirst |

$16,5 |

Casual games |

| Dec-07 |

WildTangent |

$20,0 |

Casual games |

| Nov-07 |

Hidden City Games |

$15,0 |

Virtual world |

| Nov-07 |

Zweitgeist |

undis |

Other |

| Nov-07 |

Apaja Online |

$2,3 |

Casual games |

| Oct-07 |

Numedeon |

Undis |

Virtual world |

| Oct-07 |

Star in Me |

Undis |

Virtual world |

| Oct-07 |

GameLayers |

$0,5 |

Other |

| Sep-07 |

Emote |

$8,0 |

Casual games |

| Sep-07 |

Watercooler |

$4,0 |

Other |

| Sep-07 |

RocketOn |

$0,8 |

Social games |

| Aug-07 |

Spill Group |

undis |

Casual games |

| Aug-07 |

GameForge |

undis |

Casual MMO |

| Aug-07 |

Kongregate |

$5,0 |

Casual games |

| Aug-07 |

D2C |

$6,0 |

Casual games |

| Aug-07 |

Conduit Labs |

$5,5 |

Social games |

| Aug-07 |

Doppelganger |

$11,0 |

Virtual world |

|

Jul-07

|

Weblo |

$3,2 |

Casual MMO |

|

Jul-07

|

Grockit |

$2,7 |

Other |

| Jul-07 |

Geewa |

$2,0 |

Casual games |

| Jul-07 |

WatAgame |

$4,0 |

Virtual world |

| Jul-07 |

Three Rings |

$3,5 |

Casual MMO |

| Jun-07 |

Metaversum |

several m€ |

Virtual world |

| May-07 |

Frenzoo |

undis |

Virtual world |

| May-07 |

Multiverse |

$4,2 |

Virtual world |

| May-07 |

Avaloop |

Undis |

Virtual world |

| May-07 |

World Golf Tour |

several m$ |

Casual MMO |

| May-07 |

Two Way Media |

$10,6 |

Other |

| Mar-07 |

Kongregate |

$1,0 |

Casual games |

| Mar-07 |

Flowplay |

$0,5 |

Casual MMO |

| Mar-07 |

Gaia Interactive |

$12,0 |

Virtual world |

| Feb-07 |

Zweitgeist |

$0,6 |

Other |

| Feb-07 |

Virtual Air Guitar |

$0,2 |

Casual games |

| Feb-07 |

Doppelganger |

$5,0 |

Virtual world |

| Dec-06 |

Metaplace |

$5,0 |

Casual MMO |

| Dec-06 |

D2C |

$1,5 |

Casual games |

| Nov-06 |

WatAgame |

Undis |

Virtual world |

| Nov-06 |

Bunchball |

$2,0 |

Social games |

| Oct-06 |

Mind Candy |

$7,4 |

Virtual world |

| Aug-06 |

WildTangent |

$13,0 |

Casual games |

| Jul-06 |

Sulake |

$8,0 |

Virtual world |

| Jun-06 |

Stardoll |

$6,0 |

Virtual world |

| Jun-06 |

WeeWorld |

$15,5 |

Virtual world |

| Feb-06 |

Stardoll |

$4,0 |

Virtual world |

| Dec-05 |

Doppelganger |

$8,5 |

Virtual world |

| May-05 |

WeeWorld |

$5,5 |

Virtual world |

| Apr-05 |

Doppelganger |

$2,5 |

Virtual world |

| Jan-05 |

Big Fish Games |

$8,7 |

Casual games |

| Jan-05 |

Sulake |

$24,0 |

Virtual world |

| ? |

Sulake |

undis |

Virtual world |

| May-04 |

WildTangent |

$16,5 |

Casual games |

See the full table with details for this sector.

Category definitions

Much of the analysis done in this blog post is based on assigning companies to the categories. The companies are assigned to categories subjectively and only using publicly available info (i.e. no research has been done into actual user experience to validate the companies’ claims). Category assignment has been done solely by Jussi Laakkonen and doesn’t represent the opinions of Adam Martin. The categorization part is the weakest and most subjective part of my analysis, so you should take it with a ton of salt.

The categorization uses the terms Virtual worlds, Casual MMO, Social games and Casual games as defined loosely below:

Virtual world

- free form play, not a lot of rules

- large scale multiplayer, concurrent

- some sense of world/place (e.g. rooms, gathering areas)

- avatars

- persistent world

- typical example: Habbo Hotel, Second Life

Casual MMO

- gameplay with defined ruleset

- shorter sessions, more accessible than full-fledged MMORPG

- more mainstream topics (e.g. sports, dance) than typical MMORPG

- large scale multiplayer, concurrent or asynch

- some sense of world/place (e.g. rooms, gathering areas)

- avatars

- persistent world

- typical example: Maple Story, World Tour Golf

Social game

- gameplay with defined ruleset

- asynch multiplayer or small scale concurrent multiplayer

- utilizes social graph and/or only available on a SocNet

- limited or no use of avatars

- typically persistent world

- typical example: Friend for Sale, Who has the biggest brain

Casual game

- gameplay with defined ruleset

- single player or very limited asynch/concurrent multiplayer

- no use of social graph

- no use of avatars

- non-persistent world (with the exception of leaderboards)

- typical example: Bejeweled, Desktop Tower Defense

What this helpful? Where to dig in?

If you found this data and analysis to be helpful, feel free to shout out in the comments ;-). Also I’d be happy to hear about ideas on further analysis on the data. Any corrections (errors, omissions etc) are more than welcome!

The data is licensed under the Creative Commons Attribution, Non-Commercial license.

The data is licensed under the Creative Commons Attribution, Non-Commercial license.

World changing entrepreneurs & companies start small

September 13, 2011(not really back to blogging, but had a spare moment and thought to blog after a long time).

I was reading up today how Dustin Moskovitz (Facebook co-founder, now Asana founder), Peter Thiel & Max Levchin of Paypal fame et al were lamenting at Techcrunch Disrupt how the startups in the valley don’t do enough to “change the world”. I found myself nodding as well as shaking my head.

Sure, we’ve got enough of people trying to solve photo sharing. Like films (Deep Impact, Armageddon) there seems to be trends that follow-on entrepreneurs pile on. Cloning and iteration do benefit the industry, but you also want folks to working on something new and innovative. Agreed with these gentlemen there.

At the same time it boggles my mind that these awesome entrepreneurs are pooh-poohing companies that start small. Facebook started out as a hot-or-not clone called Facemash. Mark Zuckerberg gave an interview in 2005 that there probably wouldn’t be much more to be done outside of college & university audiences. Peter & Max started Paypal with a relatively small concept of beaming money from a Palm Pilot to another.

I believe world changing companies and entrepreneurs start small by necessity. When you find traction, you scale both as the company and as the entrepreneur. Dustin, Peter and Max have scaled and so have their ambitions and their point of view. I’m sure they remember exactly where they come from and how they started small, but they see “wider” now. I don’t think they are dishing the best kind of advice though. Yes, you need a vision for a big company that at best times will change the world for better, but you absolutely need to start small. Unless you already co-founded Facebook, Paypal, Genentech, AdMob, Google, … and can afford to short circuit the process (of scaling yourself as an entrepreneur & resources for your company).

Start small. Scale when you can. Work towards a big vision.

Categories: business

Tags: comment, entrepreneurship

Comments: 4 Comments